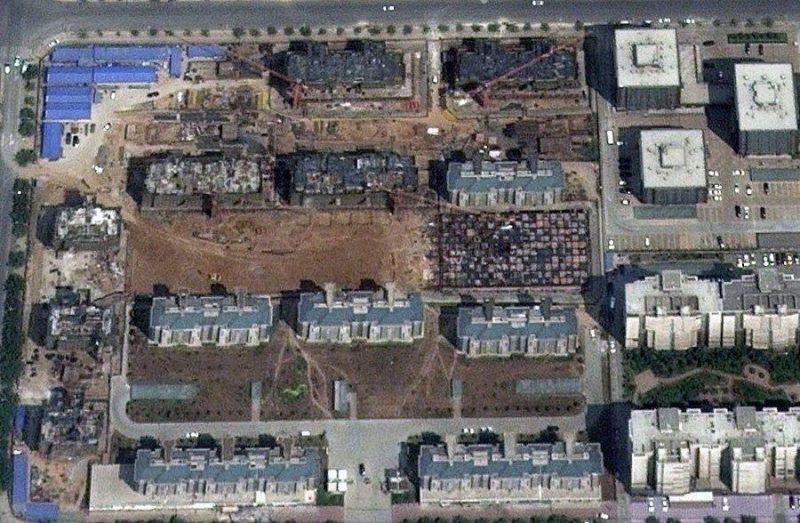

Screen shot from Google Earth's satellite image of a Chinese ghost city. Via China's state own Xinhua News July 2013.

Wary of the fallout over an overheated property market, some Chinese officials and high-profile think tanks have suggested that the country implement a property tax to stabilize the volatile industry, a proposition that is sparking intense debates on Chinese social media.

Jian Kang, a delegate of the political advisory body Chinese People's Political Consultative Conference and a member of a government think tank on economic policy, has called for launching a property tax in a bid to quell a housing market full of rampant speculation, but he has also warned that the public shouldn’t expect the tax to sharply bring down housing prices, especially in the largest cities.

As well, a deputy minister of China’s Ministry of Housing and Urban-Rural Development said in an official news conference in late February that the government was accelerating the legislation for a property tax.

Currently, those buying property in China need to pay a number of taxes, including stamp duty, land value increment and income tax on the transaction. That means investors can hold a vast portfolio of properties and pay no annual tax on them after the initial purchase.

The Chinese government experimented with introducing a property tax in the cities of Shanghai and Chongqing in 2011. But the tax rate is less than 1 percent and the regulations were carefully written to affect only the very wealthiest with the most expansive property holdings. The tax has had negligible impact on the property market in both cities.

The reintroduction of the idea of a widespread property tax has triggered wide debate. Some believe that the full implementation will restrain speculation on the housing market and tame prices, while others believe that the taxation will encourage the market and push up prices.

China’s government at all levels have long relied heavily on selling monopolized land for revenue. More than half of annual revenue in China’s largest cities such as Beijing, Shanghai and Guangzhou have stemmed from land sales.

Fang Jianxin, a newspaper columnist, argued that the current housing market bubble stems from the monopoly of land by the government:

重庆市为何能做到房价平稳?是土地供应量大增自然抑制房价无序暴涨!体现管理者水平问题。很多地方政府官员依赖卖地搞建设,做政绩,这才是土地市场管不好的深层次原因。地价暴涨,房价自然难下跌!首先要控地价但地方政府收入就少,所以采取控地价的政策多数是隔靴搔痒。

Why are housing prices in Chongqing moderate? The increased supply of land will naturally suppress the price. This is a land management issue. Governments from other cities depend on land revenue for developing infrastructure and showing off their success. This is the root cause of the problem in land management. If land prices are high, housing prices will not drop. But if the governments reduce the price of land, their income will drop, and they don't have the motivation to do so.

Such a revenue model based on land sales also would explain why China’s local governments have been keen to grab land from country folk, only to later sell it to developers, over the past decades. It also would suggest why it’s so difficult for the Chinese government to roll out a property tax, a policy taken in many developed countries — it might cool the property market and reduce revenue from land sales.

‘Housing should be used to live in, not for speculation’

Heavy reliance on the housing market for economic growth in China has ushered in exploding housing prices in the largest cities and oversupply in third- and fourth-tier cities. Soaring home prices in big cities have also fermented complaints and unrest among residents, which could pose a potential threat to the Chinese Communist Party’s ruling.

China’s central government, however, does seem to be trying to get local governments to wean off selling land. Chinese President Xi Jinping declared during China’s central economic conference in late 2016 that “housing should be used to live in, not for speculation,” which many experts have expected might signal a tightening of regulations on the housing market.

Economic Information Daily, a newspaper under the Chinese state news agency Xinhua's umbrella, touted that imposing a property tax could guide capital to flow from the virtual economy to the real economy, promoting industrial development which has long been vexed by a lack of capital. Caijing, a well-known finance magazine in China summed up Economic Information Daily's front page news on Weibo, China's most popular social media platform:

【经济参考报头版:房地产税有利资金“脱虚向实”】房地产税可能在短期内对住房市场造成一定影响,但我国现行较高的首付比,可以给予金融机构房贷资产质量充足安全垫;且房地产税有助于减少社会资金向房地产业聚集,反过来又会降低整体房地产金融杠杆,并引导资金“脱虚向实”。

A property tax could help capital flow out of the virtual economy to the real economy. Imposing a property tax may affect the housing market in short term, but China’s higher down payments would protect banks’ mortgage assets. A property tax would also help reduce private capitals concentrating in the real estate market, which in turn would lower its financial leverage, and guide capital to leave the virtual economy for the real economy.

However, some economists have cast doubt on the government’s determination to push up the introduction of a property tax, given the government’s heavy reliance on selling land and a lack of nationwide registration of home owners. To date, China’s lawmakers have not started legislative process for property tax.

Other economists argue that the root cause of soaring home prices in a couple of the largest cities lies in a serious imbalance in how national resources are distributed. Too many premium universities, hospitals, state-owned enterprises and other important resources controlled by the government are concentrated in Beijing or Shanghai, stimulating those property markets with their presence.

‘Too silly and naïve to count on a property tax’

For years, Chinese property owners and investors in large cities have enjoyed a free ride to wealth driven by rapid growth in home prices and a lack of property tax to cut the gains.

Ma Guangyuan, a well-known economist, said on Weibo that he was pessimistic about a property tax’s effect on lowering housing prices, pointing to the government's land monopoly and the oversupply of money as the underlying reasons:

房产税抑制不了房价,这是很多国家的事实。只要房价涨幅超过持有成本,还是会选择买房子。把抑制房价的希望寄托在房产税上是太傻太天真了!

As a matter of fact in many countries, property taxes can’t curb housing prices. People prefer to buy property only if housing surges overtake holding costs. It’s too silly and naïve to count on a property tax to contain rising prices!

The economist’s view attracted criticism that many speculative buyers could hold dozens of homes without any cost, which fuels speculation and is unfair to common buyers. Weibo user “Autumn Leaves” said in the comment thread:

拥有几十几百甚至更多套房产的人,无需考虑持有成本,这是什么理?竟然还有这么多人支持,难道人人觉得投机炒房合情合理?人人参与并乐与其中,那房价永远暴涨很正常啊。

Why could those who own dozens or hundreds of homes never worry about holding costs? It’s surprising that so many people oppose a property tax. Does everyone think speculative buying is reasonable? Housing prices will continue rising if everyone tends to participate in the speculation.

Qi Junjie, an overseas Chinese student, also believed the property tax is an effective means to contain property investment:

曼哈顿要是没有房产税,早就被中国人炒爆了!可能会变成唐人街!

Housing speculation in Manhattan would be rampant by Chinese without a property tax! It could become Chinatown!

Given China's growth model being heavily reliant on land sales and property market speculation, Weibo user Frank Lei expressed his pessimism with a satirical comment:

古有地主收租,今有天朝卖房,实业误国,炒房兴邦

Landlords made money on collecting rent in ancient times, now people make a fortune selling homes. Doing industry harms the nation, while housing speculation makes the country prosperous.