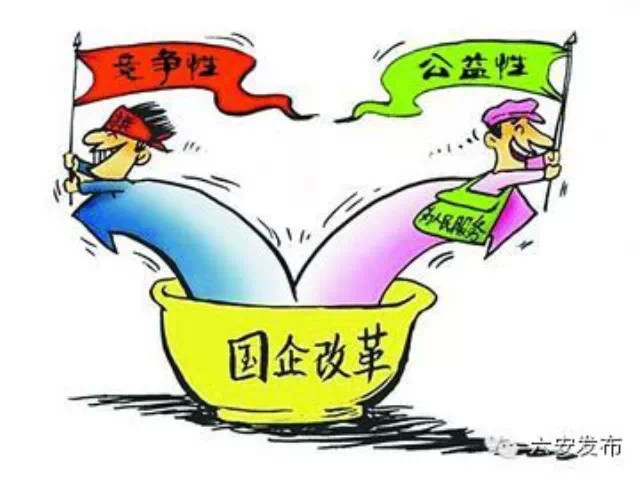

A cartoon circulated widely online depicting the contradiction in enhancing both competition and public ownership. Non-commercial use.

The Chinese government has finally introduced a concrete reform plan for its state-owned enterprises (SOEs), but any economists who were hoping for privatization will be sorely disappointed.

State-owned enterprises (SOEs) are legal entities owned by the Chinese state and engaged in commercial activities. In addition to giant banks or large telecommunications companies, Chinese state-owned businesses also include hotel chains, property development companies, restaurants, and shopping malls. Most of these less “strategically important” businesses are now in dire economic straits.

Though both China’s slowing economy and the rampant corruption in SOEs make the reform imperative, some economists have found the measures too conservative, failing to break with the traditional ideological limitations on business and hit at the benefits of vested interests.

According to the document, released on September 13, China will seek to modernize its state-owned enterprises, enhance state assets management, promote mixed ownership, and prevent the erosion of state assets.

The government will set up several state-owned capital operating companies, similar to Singapore's “Temasek-style” SOEs. The State-Owned Assets Supervision and Administration Commission will no longer directly intervene in the running of most SOEs and the role of the government will be shifted from “management of assets” to “management of capital” through the state-owned capital investment corporations.

At the same time, the document also stresses that “the Party leadership over SOEs is vital in ensuring the socialist direction of their development and enhancing their competitiveness and competence.” To this end, “the statutory status of the Party organizations in firms should be clarified in corporate governance structure.” Instead of privatization, the new plan emphasizes the strengthening of public ownership.

This approach reflects contradictions inherent in the 2013 economic reform blueprint, which called for giving markets a “decisive role” in resource allocation while preserving a “dominant role” for the state sector.

In Twitter-like Weibo, many economists, in particular those who believe privatization plays a vital role in overhauling the SOEs and reshaping the country's economy, have criticized the guidelines for their failure to resolve the existing corruption problems of the SOEs.

Liu Shengjun, a famous reformist economist questioned the stress on party leadership and called for a deeper ideological emancipation to further push the SOE reform:

思想解放将是决定国企改革命运的关键。就国企改革的观念障碍而言,我们必须就两个问题展开认真的辩论:国企做大做强有利于让市场发挥决定性作用、有利于中国经济转型吗?坚持党的领导,就必然要强化党组织在国企的作用吗?要回答这两个问题,需要一场新的思想解放

Ideological emancipation would be the key to achieving SOE reform progress. As for the conceptual obstacles for SOE reform, we must launch a serious debate about two problems: Will SOE growing bigger and stronger be favorable for allowing markets to play a decisive role in China’s economic transformation? Will adhering to the party’s leadership strengthen the party organization’s role in SOEs? We need a new ideological emancipation campaign to answer these two questions.

Sheng Hong, Director of Unirule Institute of Economics, an independent think-tank, believes that the SOEs’ corruption problem cannot be resolved without challenging their monopoly status:

现在因为垄断国企存在,占有全国资源的很大一部分,这么大的资源造成的损失一年得数万亿。我国经济增长减速,很大程度上因为垄断国企存在和保护垄断的结果,这是一个迫在眉睫的问题,不改一天损失上百亿。如果不想解决这个问题,那改革是干嘛?

The state-owned monopolies occupy the majority of the country’s resources, leading to annual loss of trillions of yuan. The economy has slowed largely because of the existence of state-owned monopolies and the protection of these monopolies. This is an imperative problem, costing about ten billion yuan a day. Why does the government carry out reform if they don’t want to solve this problem?

改革是解决问题的,这次的改革基本没有针对我说的问题,比如说国企垄断权问题、国企免费和低价使用国有资源的问题、不上交利润的问题、国企内部没有限制分配的问题,这些问题才是问题。在我看来更严重的是,国企的存在就是问题。

Reform is meant to solve problems, but this plan doesn’t address those issues I have talked about, such as SOE monopoly, SOEs using state-owned resources for free and at a low price, not turning over profits, not limiting allocations inside SOEs. These are the real problems. In my opinion, what’s more serious is that the existence of SOEs in itself is a problem.

Zhang Weiying, a famous economist in Peking University (Beijing) also criticized the “dominant status” of the SOEs:

目前的经济增长放缓说明,除非彻底改革增长模式,中国很难持续保持经济高增长。其次,国企在关键行业的垄断已造成广泛的不满。大量研究都证明国企不如民企有效率。如果民企不能成长为真正的市场主体,我相信中国经济会在将来遇到大麻烦

The current economic slowing proves it’s tough for China to maintain high economic growth unless the government overhauls the growth model. Secondly, the SOEs’ monopoly in key industries has generated wide complaints. A great deal of studies have proved SOEs are less efficient than private companies. I believe the Chinese economy could meet with big trouble if private companies can’t dominate the markets.

Zhang Wenkui, a research fellow in the Development Research Center of the State Council doubted whether the Singaporean Temasek-style SOE model could work in China:

我国学习淡马锡已经学了十多二十年,根本学不来。淡马锡下面的国企搞得不好、资本回报低,或者资本需要转移到其他领域去,淡马锡就可以卖掉;还有,淡马锡的独立运营是受到新加坡的法治体系保证的,可以基本上避免政府干预和长官意志。这两个核心要素中国很难学。

Having studied Temasek for over a decade, it's clear China can’t replicate its success. Temasek can sell off its SOEs if they underperform or if it needs to invest into other areas. Temasek’s independent operation has been guaranteed by the legal system of Singapore, basically fending off government and officials’ interventions. It’s very tough for China to learn these two core factors.

Wu Jinglian, a prestigious reformist economist sought to persuade the CCP to drop the Soviet model of the socialist economic principle:

我写了给党中央的信《关于社会主义的再定义问题》。针对‘国有制是公有制高级形式,是社会主义必须追求的目标’,我说这是苏联教科书定义,是错的。我赞成邓小平‘社会主义本质在于逐步实现共同富裕’。是不是社会主义跟国有制比重大小没有关系!

In a letter “On the redefinition of Socialism” to the Party Central Committee, I argued that the rhetoric that “state ownership is the advanced form of public ownership, the aim that socialism must pursue” is the definition from the Soviet Union’s textbook and is wrong. I agreed with Deng Xiaoping that “the essence of Socialism is to gradually realize common prosperity.” Socialism has nothing to do with the ratio of public ownership!

Wu further argued that the party-state monopoly of the economy could eventually lead to crony capitalism:

改革就是要打破“国家辛迪加”(党国大公司)。现在就是列宁的国家资本主义:有市场,但国家掌握着所有的“制高点”,“制高点”在中国叫“命脉”。建立了社会主义市场经济体制,但其实有沉重的旧体制遗产比如“国进民退”,继续发展下去就是权贵资本主义

Reform is meant to break the “State Syndicate” (party-state monopolies). The current Chinese economy is actually the state capitalism claimed by Lenin: Despite the existence of markets, the state controls all the “commanding heights” of the economy, often called the “lifeblood” of China. Although China has built the socialist market economy, it bears the heavy legacy of old system, so that “as the state sector advances the private sector withdraws.” If it continues to develop [this way], China will become a system of crony capitalism.

4 comments

Sounds like people were misled by the statement ” giving markets a “decisive role” in resource allocation”, and knowing free market is the most effective an efficient way to allocate resources and increase overall total profits for all enterprises, SOE and otherwise, assumed that ccp would let more free market features into Chinese economy. However, there are too many statements from PRC government about better control, by the party of course, better efficience (of the SOEs of course), better effectiveness (fir the PRC government policies, of course), more competitiveness (of SOEs, not all enterprises), better competence (of SOEs, not China). That can be interpreted as CCP wants SOEs be more obedient, doing what they are told to do well, but nothing else; more profitable. What better way to ensure competitiveness (within China) than to give these SOEs total and complete monopoly within China ? Since the national economic goal is to increase internal consumption, monopoly will make these SOEs as profitable as CCP wants, since most SOEs are in the necessities market where consumers will consume whatever the price. On top of these, all ccp need to do is shuffle the deck chairs, let the friends and family of the powerful to get the most lucrative positions, and ensure tracks are covered. That’s what SOE reform means.

‘On top of these, all ccp need to do is shuffle the deck chairs, let the friends and family of the powerful to get the most lucrative positions, and ensure tracks are covered.’

Which is exactly what Singapore’s GIC and Temasek have actually been doing for the past 3 decades if you look closely at the Board of Directors in these two GLCs. And for your information, the heads of both GLCs are actually the Prime Minister and his wife of his second marriage respectively, all out in the open. Many of the current Government Officials also hold positions there, including one who stood for the Government in the current General Elections and won her seat (Sun Xueling), underscoring its 5th Place in the Crony Capitalism Index (China is 19th in the same list actually) and the risk they are building up for themselves, blatantly ignored by the global community due to their own vested interests in the region!

Read The Economist’s caveats on their own “crony-capitalism index” and you’ll know why Singapore is 5th and China is 19th…

We have to understand that the Re-form of China’s state-owned enterprises is the good way for China’s centre government to claim its ownership of them companies . Also it is a good way for them to clear those corrupt managers because most of enterprise have corruption problems and people who are in charge of these companies are stealing from these enterprise. Present Xi wants to use reform activities to ease corruption problem and change the ownership from state-owned to national owned . It actually has little to do with free markets.