Niobium, also known as columbium, is among the most utilized metals in the world, and Brazil has the great majority of the world's niobium deposits. However, exploitation of niobium resources within Brazil raises questions about the total profit generated by private companies and public organizations.

According to the blog Nióbio do Brasil [pt], entirely dedicated to this metal:

a aplicação mais importante do nióbio é como elemento de liga para conferir melhoria de propriedades em produtos de aço, especialmente nos aços de alta resistência e baixa liga usados na fabricação de automóveis e de tubulações para transmissão de gás sob alta pressão.

Niobium reserves

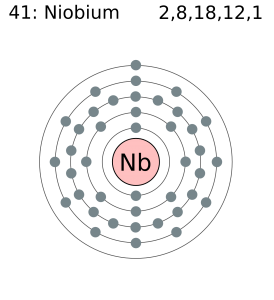

The ductile metal, represented by the symbol Nb and atomic number 41, is highly resistant and can be found in jet engines, as well as in the naval industry and high diameter tubes utilized in construction. Because of its growing use and increasing exploitation in the last few years, its value has also oscillated.

According to data published by the American government, Brazil has around 95% of the world's niobium deposits, distributed among the states of Minas Gerais, Amazonas and Goiás. Roberto Silva, author of the site Economia BR, describes [pt] that:

analisando o total de reservas nacionais de nióbio, (…) com relação a soma de suas reservas medidas, indicadas e inferidas, aponta em primeiro lugar o Amazonas, cujas reservas de nióbio apresentam 82,7% do total do país e estão localizadas no município de São Gabriel da Cachoeira.

The ore has been commercially valued at a price of 44 US dollars/kilogram. For comparison, in 2007, the same metal was commercialized at an average price of 52 US dollars/kilogram.

In 2006, the world production of niobium was estimated at 59,900 metric tons and Brazil produced 56,000 of this total. An article published on the website of Canadian mining company Taseko Mines Limited, affirmed recently:

There is a growing demand for niobium. Global annual consumption of ferro niobium is over 200 million pounds per year and growing at 5-7% per year.

Two hundred million pounds correspond to approximately 90,718 metric tons. While the average selling price has decreased in the last five years, exploitation and consumption of the metal has increased worldwide.

Pricing queries

In an article written by Victor Tagora for the Revista Meio Ambiente [pt], which draws attention to niobium’s strategic position in Brazil’s economy, the author describes that:

fontes dignas de atenção indicam que o minério de nióbio bruto era comprado no garimpo a 400 reais/quilo, cerca de U$ 255,00/quilo (à taxa de câmbio atual e atualizada a inflação do dólar)

Slice of a superconducting cable made from niobium-titanium alloy. Photo by Flickr user Swamibu (CC BY-NC 2.0)

Even though the value is well above other international indicators, the author concludes that:

se o Brasil exportasse o minério de nióbio a esse preço, o valor anual seria US$ 15.300.000.000 (quinze bilhões, trezentos milhões de dólares). Se confrontarmos essa cifra com a estatística oficial, ficaremos abismados ao ver que nela consta o total de US$ 16,3 milhões (0,1% daquele valor), e o peso de 515 toneladas ( menos de 1% do consumo mundial).

Even if we calculate the same final amount by taking the value of 44 US dollars/kilogram as a base, and taking into consideration 95% of world’s estimated production, we would get to a value of US$ 3,792,000,000/year. Such great variation of values has a lot to do with the fact that the metal is not estimated in commodity markets, such as the London Metal Exchange, but only through closed prices in transactions amongst companies.

Edvaldo Tavares, Doctor and Executive Director of Sistema Raiz da Vida, clarifies in the Revista Decifra-me’s website [pt] that,

Nas jazidas de Catalão e Araxá o nióbio bruto, extraído da mina, custa 228,57 dólares e é vendido no exterior, refinado, por 90 dólares. Como é que pode ocorrer tal tipo de transação comercial com total prejuízo para a população do país, é muito descaso com as questões do país e o desinteresse com o bem-estar do povo brasileiro.

In the website [pt] of the Ministry of Development, Industry and Foreign Trade, data about the Brazilian trade balance details the total value of exports per commodity – among them aluminum and iron ore. Niobium is not listed.

Obviously, all mineral exploitation must take into consideration environmental matters and social impact. However, with all this wealth in Brazilian soils, it seems inevitable to ask who is being exploited through niobium.

3 comments

Holy shit. that is a massive difference. 0.1% of the actual exports. Good work.