New housing policy issued by the State Council April 17 has received an unprecedented reaction from the public, Southern Weekend reports. Analysts and economists have called the policy “the strictest in history.”

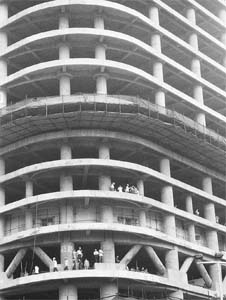

Construction in Guangzhou, Guangdong (photo/ Don Weinland)

The State Council has requested an increase in down payments on loans for second homes. Buyers looking to purchase a second home less than 90 square meters must make no less than a 50 percent down payment. The ratio for properties over 90 square meters is set at no less than 30 percent.

Loans for the purchase of third homes have been temporarily stopped, as have loans to buyers from outside regions who cannot prove a year of local tax or social insurance payment. This is the first policy to regulate the purchasing of third homes, Southern Weekend reports.

The measures come as an attempt to regulate and suppress the real estate speculation that many believe has distorted healthy market signals and driven prices sky-high.

Since 2003 a wide range of policies have accompanied, guided, and misguided the great fluctuation of the of the Chinese real estate market. Blogger Zhu Daming writes that flaws in this April’s policy change should be evident from past policy blunders. He suggests regulation of loans for second homes will ultimately lead to the continued inflation of the market.

从历史上看,二套房贷政策虽然能够在短时间内扼住市场的脖子,但后来的反弹是更猛烈,二套房贷政策是一项被实践证明是错误的政策。2007年收紧二套房政策,是导致2008年成交量暴跌的最主要工具,但是,暂时的打压并没有真正解决房地产的问题,反而导致2009年房地产市场的暴涨。

Coming from a historical perspective, policy concerning loans for second homes can grab the market by the neck in a short period of time, but the following rebound will be fiercer. [This] policy has been proven in practice to be flawed. Policy that tightened on the purchase of second homes in 2007 was the main instrument that caused the swift drop in transactions in 2008. But temporary suppression can by no means solve the real estate market’s problems. On the contrary it caused the explosive rise in prices in 2009.

Blogger Shuoyan Wuji sees the new policy as having an effect on the speculative activities of the middle class. He says that contrary to popular belief, middle-income populations do take part in speculation. The new policy should take them out of the picture, he writes.

首先是首付的提高本身会对投资和投机性购房形成一定的压制。当前参与投资和投机性购房的不仅仅是高收入人群,只要有能力支付首付的一般收入家庭也踊跃的参与其中。面对首付提高,相当于提高了炒房的准入门槛,势必将绝大部分一般收入人群排挤出炒客行列,由此而一定程度的降低市场冲动。

First, the hiking of down payments itself will create a fixed amount of suppression on investment and speculative housing purchases. At present those participating in investment and speculative buying aren’t only high-income populations. Middle-income households with enough resources to make a down payment enthusiastically took part in such activities. Facing a rise in down payments is relative to a rise in the threshold for speculative buying and is bound to push the vast majority of middle-income populations from the ranks of the speculators—causing, to a certain degree, an impulsive decrease in the market.

Blogger Zhu Daming disagrees. He writes that speculators invite the fluctuation that the policy will inevitably create.

为什么炒房客不惧信贷收紧呢?最主要的因素是,他们对于政策制造波段很有心得,而且,他们的资金通常是很大,贷款不贷款都无所谓。

Why don’t speculators fear the tightening of housing loans? The main factors are that they have an understanding of the wave that will be created by this policy and their financial resources are usually quite large. [They are] indifferent to the availability of loans.

Blogger Yu Fenghui writes that the new policy will indeed threaten groups with vested interests in the market. But he finds these groups poised to counteract the measures that intend to dissolve their profit.

…必须清醒认识到,楼市新政绝不会一帆风顺,巨大阻力将会逐步出现。这么大的调控力度,这么重的拳,将会伤及从房地产中获得多少年巨大利益、已经结成同盟的特殊利益集团。这些特殊利益集团绝不会甘心,绝不会坐以待毙,绝不会眼睁睁看着自己的既得利益被夺去。一定会绞尽脑汁、使出浑身解数抵制、反对甚至反扑楼市新政,竭力合谋维护特殊利益集团的利益。笔者预计在楼市新政进入实施阶段,取得初步效果时,这些特殊利益集团就会出招。

What must be clearly recognized is that real estate market policy won’t be all smooth sailing. Great resistance will progressively materialize. Such a heavy blow from this powerful regulation will injure special interest groups that have already formed alliances and have reaped great benefit from the market. These special interest groups will not be the least satisfied. They will certainly not take this sitting down, watching wide-eyed as their vested interests are swallowed up. They will certainly rack their brains and do all in their power to resist, oppose, and even counterattack the market policy in a concerted effort to preserve their interests. The author predicts that when the policy is carried out and taking its initial effect, that’s when these special interest groups will make their move.

Special interest groups aside, the report from Southern Weekend states that effects on smalltime investors have been instantaneous. According to the report, between April 15 – 18 one Beijing real estate company saw a 40 percent increase in inventory, yet an 80 percent decrease in buyers.

1 comment

Sounds like a prudent decision by the government to curb demand/human greed and avert a potential housing bubble. If this policy had been implemented in the U.S. I am certain that the real estate boom and the ensuing crash that has hit Florida, Nevada, and California would have been avoided.