Global: Bubbles, Bailouts and Stimulus Plans

Identifying the economic woes of the United States is crucial. But we should also understand that other countries are also grappling with bankrupt companies and shrinking economies. Many countries are also implementing their own stimulus plans. What are some of the examples used by bloggers around the world when they discuss the bubble economies, bailout of banks and stimulus plans of their countries?

Bubbles

The global effect of the bursting of the bubble economies in the developed world was sudden and devastating. For example, Jamaica’s dollar-earning bauxite industry has shed hundreds of jobs already because of the downturn in US car production.

In Bangladesh, the housing bubble is tied to the reliance of the country to the remittances sent by overseas workers. Now that migrant workers are returning home because of mass layoffs in Europe and US, the property boom in Bangladesh has come to an end:

The diaspora Bangladeshis have sent remittance of almost 6.5 billion US dollars in 2007. There is no doubt that remittances are good for a country's economy. But it is the sad truth that most of these remittances are used in investing in unproductive assets like lands and apartments. Because liquidity chases assets, those diaspora workers will certainly want to invest in a secured asset.

A huge sum of money is going after a tiny piece of land among limited land resources. So we have created our own bubble (like dotcom bubble). Everybody knows how the prices of lands and apartments shot up. The remittances are responsible for it.

Cambodia is also experiencing a property bubble. South Koreans are Cambodia’s biggest investors. Since South Korean businesses have been badly hit by the financial crisis, many of them have already pulled off their real estate investments in Cambodia.

Meanwhile, the Caribbean financial crisis originated in part from the sharp drop in methanol and real estate prices. In Antigua, the face of bank fraud is U.S. billionaire Allen Stanford who has been charged with investment fraud. Stanford has considerable investments in the Caribbean.

For many months, the Brazilian government has claimed that the local impact of the economic crisis is only minimal. But recent reports have shown that Brazil is now the second most affected country by the crisis. Blogger Luiz explains why Brazil’s economy is vulnerable:

Sim, o Brasil tem um mercado interno, mas não vive só dele. Vive, também, da exportação de seus produtos. A crise atingiu não apenas os Estados Unidos, mas também a União Européia. Dois grandes mercados brasileiros. Reduziu o crescimento na China, outro mercado importante.

Romania’s lending bubble is familiar because it is almost the same credit bubble which burst in other rich nations.

Bailouts

Many companies which asked for a bailout from governments were financial institutions. The response of some governments was to nationalize these money-losing firms. Bank nationalization schemes have been enforced in some countries like Iceland and Kazakhstan. Trinidad and Tobago banks were rescued not just by their government but also by governments from neighboring countries.

Is nationalization a wise economic decision? Should bankrupt companies receive government assistance? The opinion of bloggers is divided:

Barbados Free Press criticizes the lack of transparency concerning the decision to bailout the banks in the region:

How much will Barbadian taxpayers eventually be on the hook for? Good luck finding out the truth because the amount of taxpayer money and concessions being given by Trinidad, Barbados and other countries is being kept secret from the taxpayers.

Barbados Underground, reacting to the renewed government involvement in the financial sector, notes that this unorthodox thinking should generate a healthy debate:

If in fact, “national financial institutions,” enhance the capacity of a national government to respond to crises in the financial services sector, the question may well be, not whether a country can afford a “national financial institution,” but whether it can afford not to have one. Such a perspective goes against my many years of training, but economic orthodoxy has been found so sorely lacking in this crisis that I am open to new ideas. New answers often require new questions and a willingness to engage in fresh open minded debate.

Streetwise Professor from Russia disagrees that failing banks should be revived by the government:

These are companies that should have been euthanized. No, let me correct that. They should have been terminated with extreme prejudice. Instead they are being revived, and pushed into doing the kinds of things that created the financial crisis in the first place.

This politicization of these large financial institutions makes their continued reliance on the government inevitable. Soft budget constraints are addictive. More bad loans will pile up, making these firms even less able to survive in the marketplace without government assistance.

Even poet dergachew from Kazakhstan is afraid that the nationalization of business enterprises will be counterproductive:

I am not a politician, but nothing positive will eventually happen in result of nationalization of big business that takes place in our country now. Sure, the government remains the only capable market player because it accumulates income from extraction of minerals, but a priori it is well-known fact that business people run a business better, than the government.

In Jamaica, blogger Jamaica Salt suggests a bailout for the country’s rum industry because of declining tourism activities:

It is indeed a sorry state of affairs. Usually in times of downturn, alcohol sales increase as people look to drown their sorrows! But I imagine that the dent in tourism to Jamaica is largely to blame for the decreasing sales figures of rum.

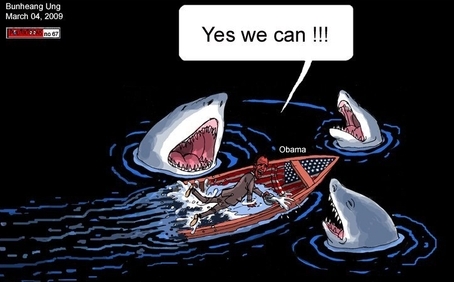

Stimulus plans

To assure the public that something is being planned or done to revive the economy, governments around the world are drafting various economic stimulus packages.

Hungary will implement a tax reform. Taiwan has signed a controversial trade agreement with China and several Southeast Asian nations. Hiring street sweepers is part of the Philippine stimulus plan. Mongolia has unveiled a 1.5 trillion tugrik stimulus plan (USD 980 million) – but critics claim the program is only intended to cover the budget deficit. Malaysia has recently launched its second stimulus program. Named as mini budget, this stimulus plan has generated a lot of discussion and also criticism in the country.

Sean's Russia Blog notes that Russia is relying on “gunpowder economics” for its version of a stimulus plan:

Feeling the pains of economic crisis? Can’t find a suitable place for expanding market share? Don’t fret. There is one sure fire way to keep those exports up. Sell more weapons.

China’s central government has announced a four trillion yuan stimulus package (USD 570 billion dollars). Below is the coverage of the stimulus plan:

The four trillion yuan is going to be spent on 10 categories, among them welfare investment such as housing for low-income, health-care system and education, also infrastructure-building such as new railways, roads and airports. Specially, aid to post-earthquake reconstruction in Si-chuan is mentioned in the agenda. Equally notable is the subsidy for farmers and an explicit announcement to increase the price of state food purchase from farmers.

But some bloggers are worried that corruption and poor infrastructure projects will cause the failure of the stimulus plan.

In Cambodia, it is the opposition which is suggesting a stimulus package. Predictably, the government rejected it. The stimulus hopes to realize the following:

- Setting up mechanisms to support and stabilize agricultural prices in order to protect farmers’ revenue and living conditions

– Investing in human resources by increasing spending on education, training and health

– Building infrastructure that Cambodia lacks most (roads, railways, water-control and irrigation systems, housing for the poor)

– Works to protect the environment and to restore the ecological system that has been disrupted nationwide, including replanting trees and dredging lakes and rivers

– tax cuts and reduction in fees for the use of public services including road tolls and the electricity price

– Special social allowances for the poorest segment of the population

– Loans with reduced interest rates for small domestic entrepreneurs and the needy.

Adolfo from Brazil, enumerates his stimulus proposal:

O Brasil tambem tem anunciado seu pacote, eu vou fazer a minha parte e sugerir um pacote tambem: que tal o governo brasileiro diminuir o imposto de renda? Operacionalmente o procedimento eh bem simples, basta devolver R$ 1.000 para cada contribuinte. Que tal esse pacote? Ele pelo menos tem o merito de devolver o dinheiro para quem ja pagou muito mais, e em nada distorce os incentives futuros em relacao ao risco.

There are bloggers who reject the wisdom of “stimulucrats”. John Quiggin from Australia shares this negative view on implementing a stimulus:

If you believe that the economy is like a swimming pool, and that no matter how big a splash some shock (such as the collapse of the financial system) might make, the water in it will rapidly find its own level, then you will agree that there is no need for, or possible benefit from, the stimulus package.

Adolfo from Brazil believes the government intervention in the economy is more dangerous:

Para a economia brasileira mais perigoso que a crise internacional são as recentes medidas anunciadas pelo governo. Os recentes anúncios de aumento do gasto público podem perfeitamente fazer estragos na economia. Ou seja, se o governo brasileiro ficasse calado e nada fizesse estaríamos a salvo. O problema é que o governo insiste em querer intervir na economia.

He explains why a bigger public spending will hurt the taxpayers:

Da próxima vez que você ouvir alguém pedindo por um aumento do gasto público lembre-se que isso implica em menos dinheiro no seu bolso, isso implica em menos dinheiro para as empresas investirem, implica que cada vez mais você dependerá dos favores do governo, e cada vez menos de seu próprio esforço e habilidade.

The quote from Bangladesh was an English translation provided by GV Editor Rezwan. The Portuguese translation was provided by GV Editor Paula.

Support our work

Global Voices stands out as one of the earliest and strongest examples of how media committed to building community and defending human rights can positively influence how people experience events happening beyond their own communities and national borders.

Please consider making a donation to help us continue this work.

10 comments

To be clear, I’m describing the view of opponents of the stimulus, but only to reject that view. I support the stimulus.

The prices of homes, including now Middle Class homes, is, I understand still falling in the USA.

This must mean that asset values are contracting both for individual home owners and the banks who hold mortgages and security. This was the starting point of the economic depression we are now in.

I was said, by others, much more clever than I, some time ago, that these prices would cease to fall, stabilise, then start to increase.

This has not happened, and I can see no reason for it to happen; just the opposite, as when employment stops, the logic for living, and owning a house in any given area goes.

Therefore, there is no reason to have pointless hope of economic recovery when the opposite, and unpleasant is reality is there to be seen.

It would be better to plan ahead for reality.

We confused – our admirable/rightful promotion of the market – with our shameful/wrongful negligence of protections – from allowing the market to become a casino house for the financial industry (including mortgage, credit card and healthcare insurance) – leading to a house of cards for the overall economy.

The economic shock/overhang/legacy we are experiencing is primarily due to the debilitating depths we got dragged to by the sudden liquidity and credit crunch emanating from growing fiduciary negligence and exploitation by our beloved, all-knowing, selfless, conflict-free, unfettered, self-regulating (de facto) judge/jury/&executors of our financial industry. For the worthy cause of a healthy market financial industry, we allowed a pervasive, ‘blindly trust but don’t verify,’ attitude/mindset/practice tempt and seduce our most pretentious masterminds comprising our financial industry club to run roughshod with other peoples (our) money for the purpose of wildly contriving self-absorbing real and imaginary (eg think Bernie Madoff, Goldman Sachs, Lehman Brothers, Enron, … styled fleecing) proceeds, fees, commissions, bonuses, and advances at the mercy of our economy.

Then, capped off with a bailout extorted by and for the very club of people who cutted off the economy at the knees.